6 Sales Comp Kickers Guaranteed to Boost Your ARR

.png)

Kickers (aka contract quality incentives) are a powerful way to boost revenue, particularly for SaaS organizations.

Designing a kicker that drives the right outcomes rather than wasting time and money hinges on understanding how your product and contract terms interact to drive customer behavior.

Contract quality is subjective to every business and its goals. It will take time and the right data to define what a “quality” contract looks like at your organization. It will take time and resources, but it will be worth the investment.

Best Practices Before You Enhance Your Sales Comp Plan with Kickers

Your base compensation plan must be well-structured before you start to enhance it with kickers.

Here is a quick rundown of the essentials:

1. Pay on your performance metric

Your performance metric is likely Annual Recurring Revenue if you’re a growing tech company. But it may be Average Contract Value or margin if you’re at a more mature growth stage.

2. Don’t pay reps recurring commission on recurring revenue

Recurring commission for contracts is a classic start-up mistake and one that lingers long after any initial benefits have faded. It’s simple: recurring commission is demotivating because reps get paid regardless of new bookings; there is no incentive to close new deals.

3. Pay your reps on booking, not on cash received

The faster you can pay reps for the revenue they bring in, the more motivating it is.

4. Overpay for performance

Top-performing reps are likely bringing in a disproportionate amount of revenue, so reward them disproportionately.

As a rule of thumb, your top 4% of representatives should be earning 2-3x the average.

5. Pay on 2 or 3 metrics or major components MAX

Simple isn’t always best, but it is important to keep your incentive compensation plan simple enough for reps to understand how to maximize their income. Where plans get complicated and confusing is when sales reps are measured on multiple measures simultaneously, e.g.:

- Measure reps on net-new ARR

- AND measure reps on renewals ARR

- AND measure reps on professional services sales

- AND measures reps on a specific activity

The overwhelming amount of components makes it almost impossible for reps to know what to chase and how to maximize their earning potential in any given quarter. Or worse, reps will focus on whatever component is easiest to sell or payout fastest, not what is best for your organization.

6. Using Kickers Alongside Accelerators in Your Sales Compensation Plan

Using an “accelerator” in your sales compensation plan means increasing a rep’s commission rate as they close more deals in a given period. They are among the most effective and commonly used mechanics to motivate overperformance with compensation.

When using a kicker alongside an accelerator, the incremental rise in commission rate earned from the kicker can be a fixed percentage or a multiplier. Generally, we use multipliers for more important kickers and a fixed rate for contract terms that are “nice-to-have” but not essential.

7. Identify Your Primary Business Goals

Kickers should not distract your reps from your primary business goals — in this case, ARR — but rather be in service to those goals.

Your base compensation plan should be motivating reps to close deals, drive ARR, and in the process, hit their accelerators to maximize income.

On the other hand, you should design kickers around ancillary goals, such as reducing churn-risk, increasing cash flow, and driving long-term ARR (i.e. contract length).

Kickers serve as an incentive to boost contract quality and remind reps to assess the quality of a deal earlier in the contract. A well-designed kicker will be top-of-mind as representatives draw up contracts or close up negotiations. You want them focused on which kickers will maximize their payout and the contract quality.

Even if your primary goal is not increasing ARR and the focus is on improving business valuation or margin instead, the same fundamental rules apply to creating your incentive plan and kickers. Choose kickers that align with those wider business objectives.

6 Kickers Guaranteed to Boost Annual Recurring Revenue

Now that we’ve covered the fundamentals of sales compensation design and considerations for when and how to use kickers let’s jump into what kickers are at your disposal.

1. Up-Front Cash Kickers

Cash flow can be a problem for some organizations. If you are looking to enhance liquidity, consider offering reps a bonus for getting customers that pay for the goods upfront.

Even for businesses without a cash-flow problem, securing payment for a two or three-year deal upfront can increase the businesses’ stability and may be worth the extra incentive costs.

The value of cash-in-hand will vary from business to business, but a good starting point for this type of incentive is the interest earned on that cash, so an increase of about 1-3% usually works well.

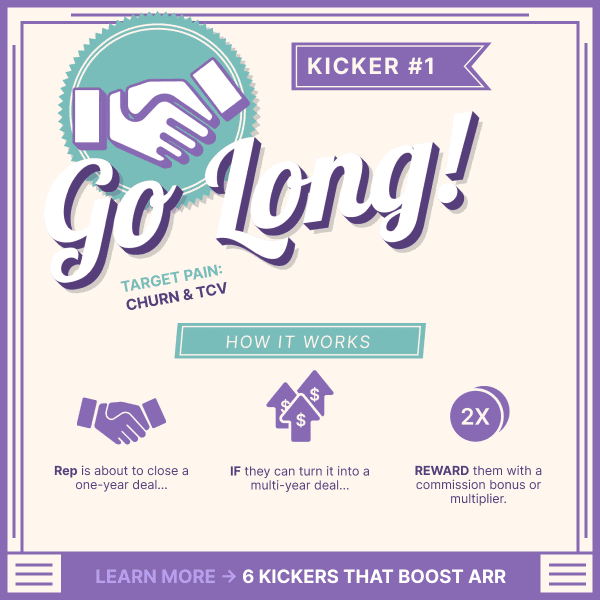

2. Contract Length Kicker

Customer churn is something many organizations struggle to prevent. If you’re worried about increasing churn, consider adding a kicker based on contract length.

Start by determining the current average contract length before customers leave and incentivize reps for contracts beyond that timeline. For example, if customers tend to churn at the two-year mark, create a kicker that pays out a 5% bonus for any 3+ year contracts.

Do contract length kickers work?

Yes, we have seen contract length kickers work very well.

At an Enterprise SaaS company (kept anonymous for privacy), Forma.ai analytics identified that multi-year contracts were tracking below target, putting a strain on the sales team and slowing business growth. To address the issue, our partner modeled and launched a fully-optimized contract length kicker using the Forma.ai platform.

Using Forma.ai, they deployed individualized, detailed dashboards to keep multi-year contracts top-of-mind for reps. After all, an incentive is only motivating if you know about it and understand it.

As a result, multi-year contract bookings grew by 161% over three quarters, helping the company lock in long-term ARR and relieve renewal pressure from their reps. Click here to read the full contract length kicker case study

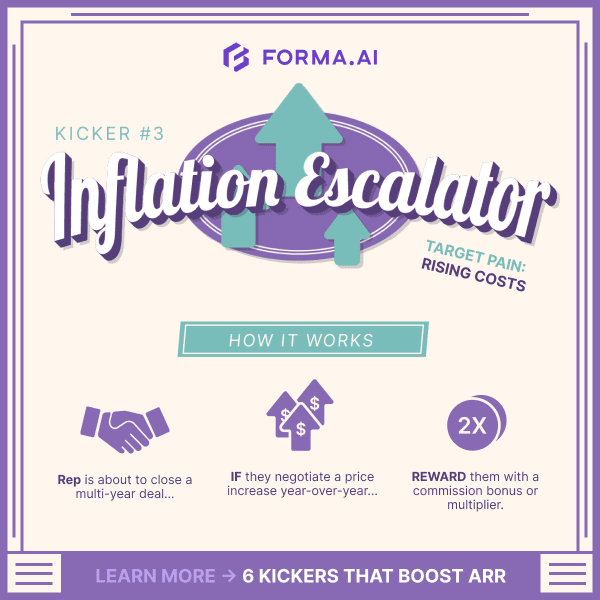

3. Inflation Kickers

An inflation-busting kicker may be profitable for companies with low churn and longer-term contracts. Many vendors avoid this by simply increasing the price every year or two on renewal, but this comes with churn risk.

One way to assure inflation doesn’t erode your margin is to stipulate a periodic price increase in contracts. To incentivize reps to secure this price increase, pay them more depending on how much of a “pricing escalator” they can negotiate into the contract.

4. Churn Kickers

This kicker type can produce astounding ROI but takes a little more work to understand how your product offering impacts customer behavior.

Churn-busters work similarly to the contract length kickers but can apply to any additional feature or package choice. For example, the data may show that customers who pay for two extra features tend to churn far less frequently.

Give your representatives incentive to put those features in the contract from the beginning, and you’re likely to see lower churn and an uptick in revenue with it.

5. Clause Kickers

Revenue recognition can be a concern when performance terms or “get-out clauses” are included in contracts or SLAs.

To reduce the risk of customers churning before their contract ends due to performance blips, add an incentive for reps to keep an early-cancellation clause out of the contract. This will encourage representatives to consider the long-term risk to the business and prevent crafty customers from inserting far-fetched commitments into the contract — that gives them an easy way out whenever it suits them.

6. Reverse Kickers

Until your organization has joined the $500m ARR club, your margin shouldn’t be that important to compensation planning; growth is typically the primary goal at this stage.

If you are among the lucky bunch, a discount kicker can help prevent reps from excessive discounting, which can put pressure on slim margins or harm incremental profitability targets.

A reverse kicker works by reducing commission by a percentage if a discount is offered on the contract, incentivizing reps to think twice before offering a discount instead of throwing it on to every deal to increase their overall sales numbers.

Don’t sweat the details

If you know anything about sales compensation design — or if you read the first half of the article — you know that you should keep your plans simple, easy to understand, and easy to administer.

If you’re concerned that a kicker would overcomplicate your plans or be impossible to administer given your current set of tools, then it might be time to consider an upgrade.

Companies like Autodesk and CareerBuilder that manage sales compensation with Forma.ai can enhance their plans with kickers fully optimized to their revenue goals while barely lifting a finger.

With Forma.ai, users never sweat the technical or compliance details of managing sales compensation because the platform takes these details into account automatically. We take the time to understand and execute for you, so you can focus on what matters — growing the business.

If you’re curious about the future of sales compensation software and how Forma.ai’s scientific approach is paving the way for truly optimized and individualized sales compensation, reach out to our team, and we’d be happy to show you.

%20(1).png)

.png)