Unleash sales motivation with powerful (and predictable) activity-based incentives

As a revenue or sales ops leader, you inherently understand the allure of activity-based incentives.

The idea being that rather than paying only on final outcomes (closed won opportunities), you incentivize reps along the way.

Theoretically, this incentive plan type should motivate adherence to sales process and strategy set by leadership, and, in turn, create healthier sales pipelines and more wins.

Behavioral research supports that the closer you can tie a specific sales activity to a reward, the more you can reinforce a positive feedback loop for sellers, and drive resulting motivation and output.

But, while optimized incentives are critical to an effective go-to-market function, it’s long been recognized that activity-based incentives (ABIs) are not without their challenges. Namely, focusing on actions vs. outcomes can result in unintended consequences—both operational and financial. ABIs can be ‘gamed’ and present some financial risk if you can’t accurately forecast associated ROI.

Ultimately, despite being enticing in theory, this type of incentive has historically been overlooked or considered too difficult to implement (which we’ll get into). Long perceived as ‘great-in-concept', ABIs have simply not been available to most organizations properly...yet.

At Forma.ai, we have recently acquired a leading sales process solution, SeaMonster, to solve this complex problem and revolutionize how revenue professionals motivate their teams.

Ahead of sharing more about our plans, let’s discuss why ABI has been so difficult to implement to date, despite its incredible potential.

Why activity-based incentives are so compelling

To start, there is data supporting that activity-based incentives work.

A large-scale study in 2021 found adding modest ABI pay on top of existing sales-based incentives could increase sales productivity by up to 9%.

Besides this powerful efficacy when harnessed correctly, activity-based compensation plans also acknowledge the reality of longer, enterprise sales cycles with multiple touch points.

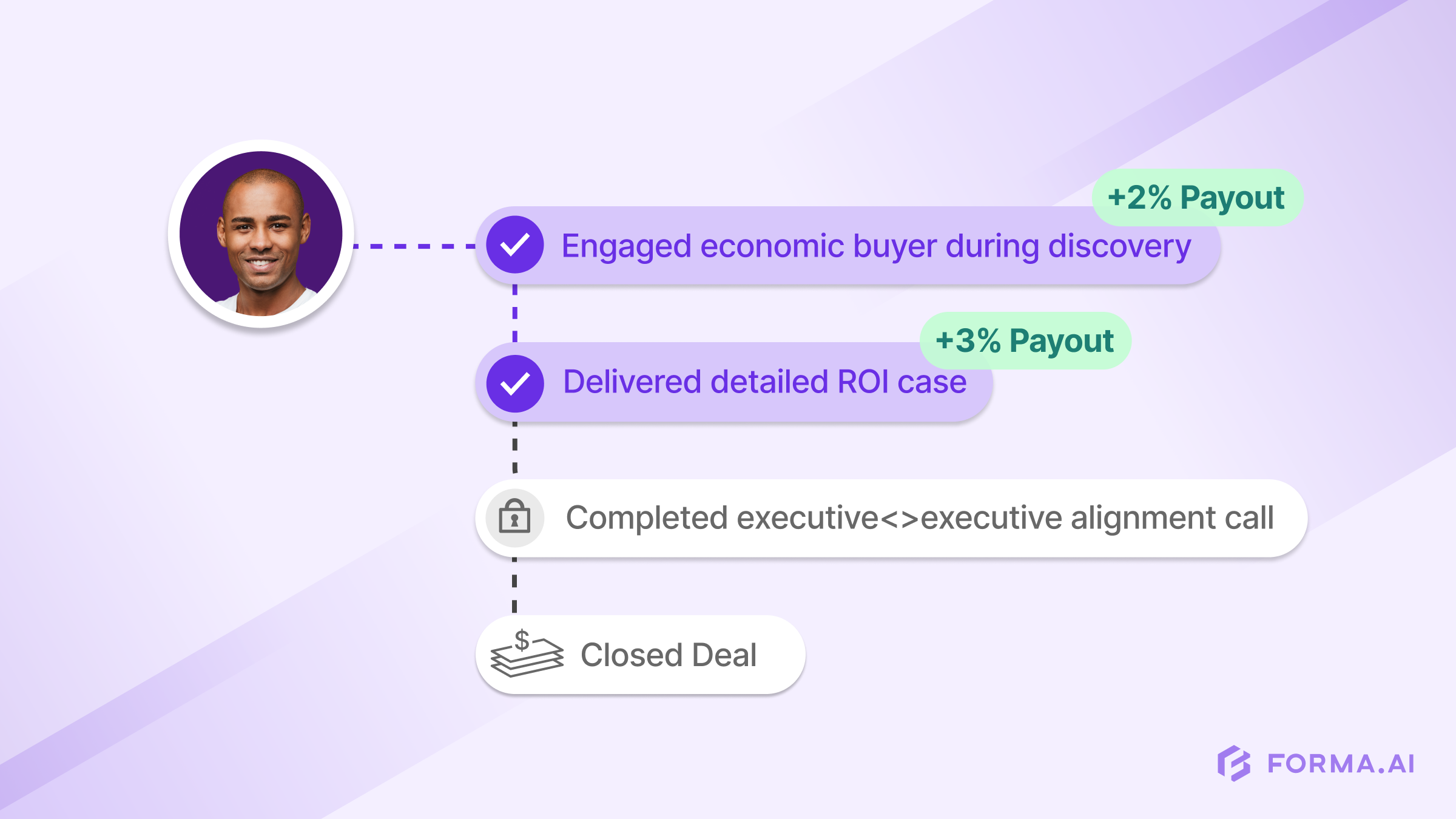

While outcome-based compensation plans reward a final sale and consider the bottom line exclusively, the gradual nature of ABIs help companies drive seller behaviors that address increasingly customer-focused outcomes throughout the sales cycle. For example, reps can be rewarded for delivering detailed ROI cases, ensuring executive or IT alignment early on, providing education sessions, or even mentioning specific products or capabilities at key points of the sales process.

In short, you can incentivize all activities that facilitate closed deals, but also revenue expansion, successful product adoption, and higher renewal rates.

And finally, because successful ABIs are ideally derived from and mapped onto a complete view of your sales process, the choice to invest in accurate, dependable data for this helps your company:

- Build clear success criteria per deal

- Drive compliance to a process that values consistent interactions

- And iteratively optimize efficiency: identifying activities with higher propensity to close deals.

So, if proven to maximally motivate sales teams and increase ROI, why aren’t more organizations implementing this type of pay incentive?

The status quo

To date, we’ve only seen large commercial brands and loyalty apps in the B2C space truly master activity-based incentives.

Take Amazon, for instance. They have a massive, structured data set tracking many points of engagement across all users on their application. With so much sophisticated––and structured––user data, the marketplace knows not just what you purchase, but tracks how you navigate the UX, interactions with buttons or prompts, offers, coupons, and more. Aggregated, this is how Amazon incentivizes users toward desired behaviors so effectively. The verified, complete data is then fuel used for:

- Recommending additional, relevant products (“People also purchased...”),

- The sequence in which you see given search results, and

- Exact promotions you are served up.

With enough reliable data to serve up incentives intelligently, Amazon constantly experiments with what motivates individual users, and can predict with financial certainty the associated revenue.

This predictive forecasting capability (and precision mapped to the customer journey) is exactly what revenue ops professionals have craved for an application in sales orgs for decades, but it’s entirely dependent on:

- A robust set of clean, dependable, verified data

- Sufficient tooling (and nuance) for configuring and modelling comp rules at scale.

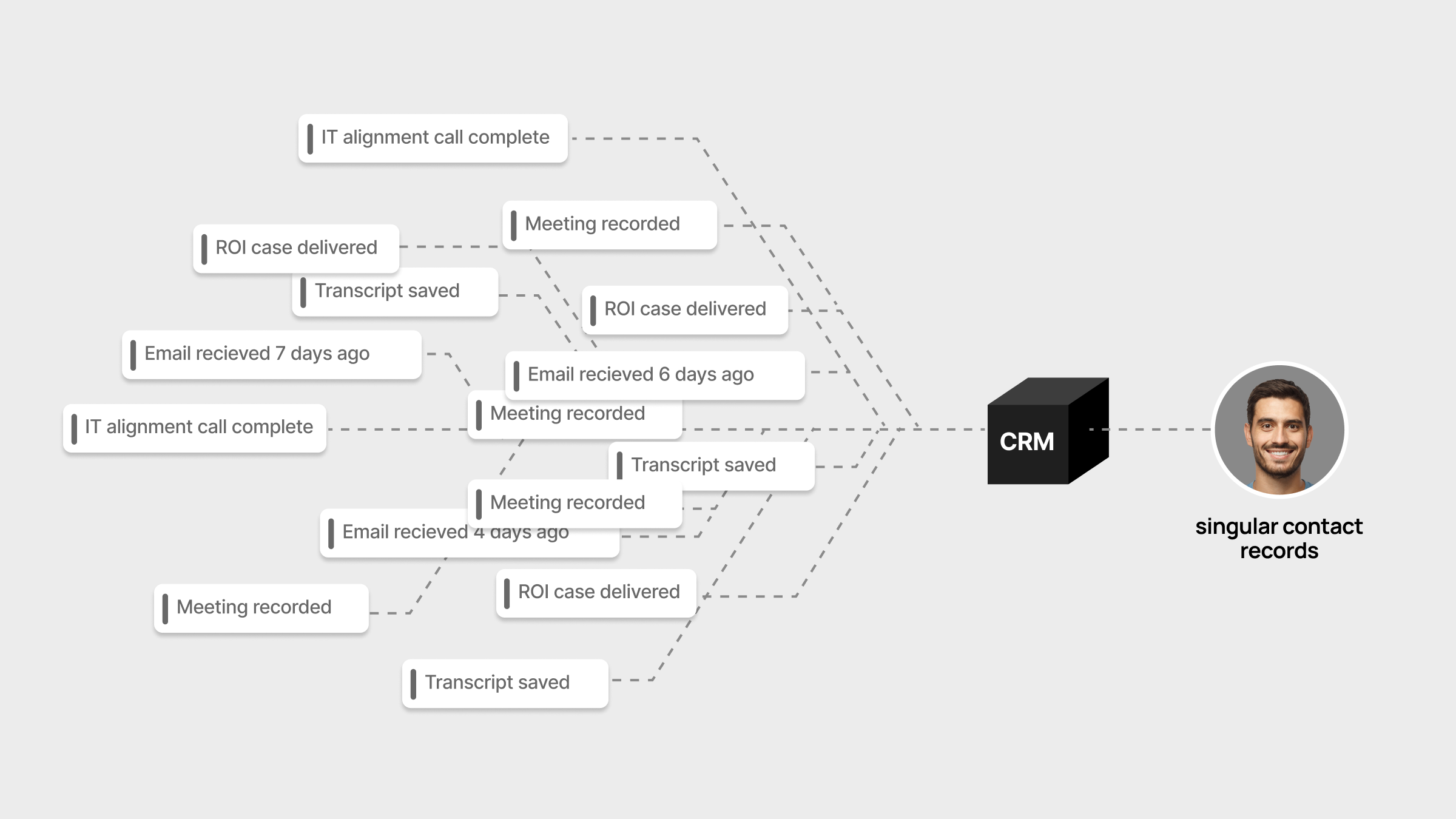

On data

Today, most organizations’ sales activity data is unstructured, unreliable, and unverified. There’s no singular source of truth. Capturing all the aggregate sales activity information (including emails, meeting invites, call transcripts, etc.) and verifying its accuracy to calculate earnings requires manual data entry from sales managers into the CRM. This manual input distracts from coaching, selling, and other revenue-generating activities.

What's more––the CRM data isn’t sufficient in that it is stored in individual prospect records, doesn’t provide a complete historical view (just a snapshot in time), and does not capture the quality of interactions.

The manual and incomplete nature of this data means it’s impossible to identify and administer the right activity-based incentives at the volume that’s required for success.

However, it's not just the messy, incomplete data that makes the challenge so difficult. It's this incomplete data, combined with the current inability to track compliance.

That is—it's not enough to know a seller completed 9 calls. Instead, you ideally want to track the granular, verified details. I.e. that there were 9 calls featuring exec stakeholders, with qualified prospects. That each call was a certain duration, and that specific product elements were discussed (confirmed via the call transcript).

Together with the data availability, this compliance is something sales organizations simply haven't had available yet to make activity-based incentives viable.

On sufficient tooling

Secondly, to implement successful ABI, you need a way to tie captured activity data to outcomes in a structured way within the solution you use for comp management.

This 1:1 connection between the verified data, the desired process/activities, and the outcomes (within an SPM platform) simply hasn’t been possible to date.

Today, the higher the volume of intricate compensation rules you’d like to rollout, the more resources and overhead you’ll require to administer your plans in a classic comp solution. This has been difficult as traditional SPM platforms have not automated complex rule management at scale.

While some SPM platforms offer activity-based incentive capability, the innate limitations around the volume of possible permutations in your plan can render your rules ineffective. The effort to build out rules and calculate out the activity is entirely manual, and there aren’t robust modelling capabilities to confidently forecast the outcomes. Activity data isn’t as rich as possible in current tools, because it’s being sourced in a rudimental way from the CRM—it’s not necessarily a real-time integration or verified activity.

Unfortunately, there’s just not been a way to accomplish nuance or account for volume and complexity insofar as calculations, administering, or easy modelling.

Until now...

Building a better way to achieve activity-based incentives

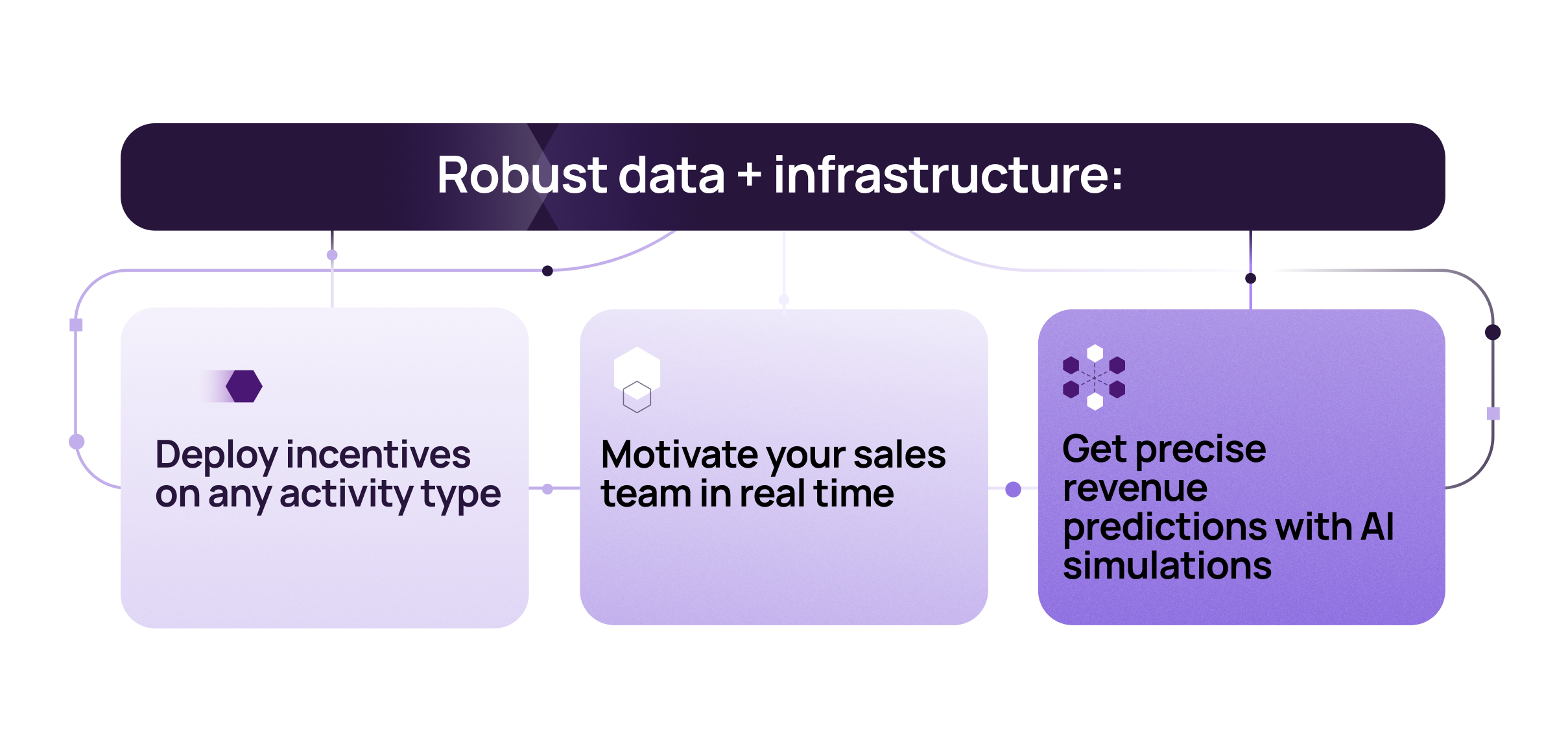

At Forma, we know de-risked ABI is only possible when you get access to a total view of the sales process, can calculate payout accurately, and can accurately predict outcomes. The agility to design and deploy within one centralized location where you'll manage compensation long-term is also key.

And so, today we’re excited to share that Forma has acquired SeaMonster. Aligned with our broader vision, this acquisition is designed to augment our sophisticated Sales Performance Management Platform capabilities and empower you to finally unleash the potential of activity-based incentives.

Global enterprises like PerkinElmer, Stryker, and Trustpilot already plan, model, and administer their comp strategies using Forma.ai’s sophisticated SPM platform. These brands also entrust automated rule creation to our proprietary AI data model. Essentially, after sharing the comp plans they need deployed in natural language (similar to chat commands in ChatGPT), our AI-supported data model automatically generates the configuration. These brands can now rapidly simulate and project financial outcomes for any change to incentives, territories, or quotas and make strategic decisions with confidence.

As the next, significant milestone, this acquisition places us in a very strong position to continue delivering the most innovative SPM solution and provide you with the critical data infrastructure necessary to change the future of activity-based incentives.

By combining Forma.ai with the activity data and sales process capabilities of SeaMonster, we envision a near-future where you can easily:

- Deploy comp incentives on any activity type (identifying activities with the highest efficiency in the sales process)

- Motivate your salesforce in realtime, and

- Get precise revenue predictions with AI-powered simulations

This plan to merge our technologies is already underway and if your organization is interested in seeing the future we envision for activity-based incentives, we hope you’ll sign up to join our digital event here. You’ll receive information on the overarching state of ABI, plus early info on our release timeline.

More global enterprises than ever are seeking ways to leverage the potential of activity-based incentives and—along our outstanding partners at SeaMonster—we could not be more excited to deliver on this vision for you.

%20(1).png)

%20(1).png)